As we have been doing every year for over ten years, today we are going to take a look at some industry statistics and we will be focused on the camera Industry in 2024 and see how it compares to 2023 and some of the years before.

As with every year that we cover the camera industry, all the numbers that you will see are based on the most recent CIPA (the Camera, and Image Products Association) numbers published in early 2025.

A few points before we start:

- CIPA only includes data from Japanese manufacturers so information about cameras and lenses made in China, Germany, Korea, the USA, etc. will not be included here.

- The information below is based on the CIPA production numbers. These are typically very close to the number of shipped cameras/lenses. We don’t have the number of actual camera/lens sales but we assume these are very close as well (cameras/lenses typically don’t stay on the shelf for a long time).

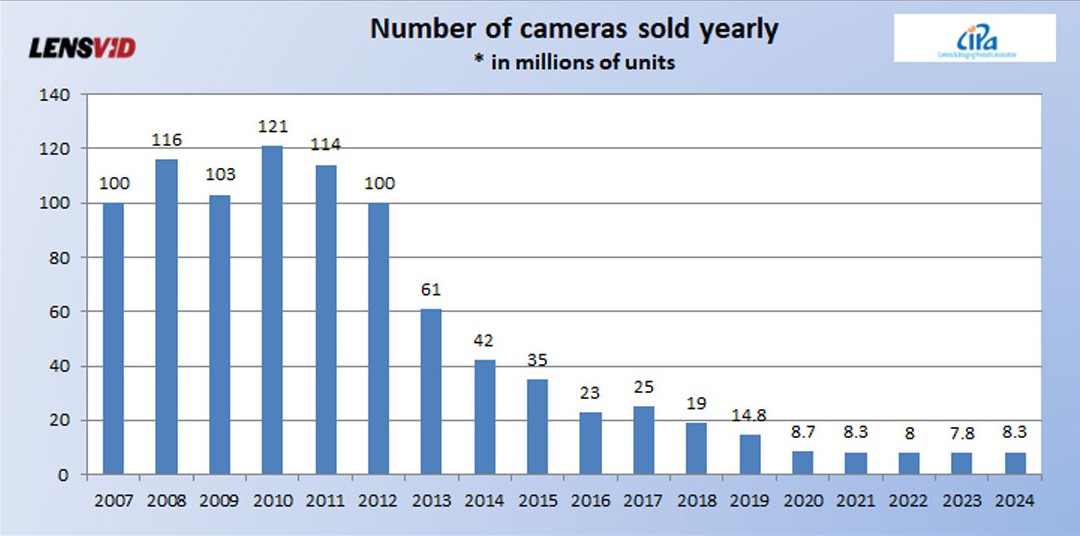

Total cameras sold

2024 was the first year since 2017 where we have seen a year-to-year increase in the number of cameras sold/shipped globally – from 7.8 million in 2023 to 8.3 – an increase of over 6%.

Does this mean that the camera industry has reached the bottom in 2023 and we are only going to see sales increases from now on? we are not sure but the actual breakdown later on in this article might help us get a better understanding of trends.

Total number of cameras shipped/sold in 2007-2024

Total lenses

Total lenses

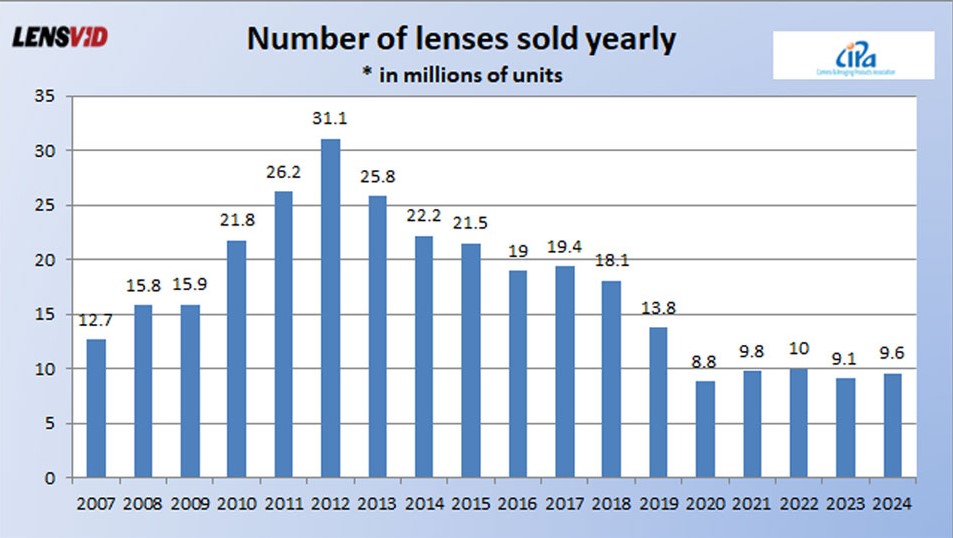

We always like to look at the number of lenses sold since these give a greater feel of the status of the industry as a whole compared to simple cameras. In 2024 we have seen a very nice increase of about 0.5 million lenses compared to 2023.

The table below lacks an important piece of information (that we also neglected to mention in the video) and that is the division between APS-C (and smaller) coverage lenses vs. that of FF (and larger) coverage lenses. In 2024 out of 9.6 million total lenses, about 4.5 million were FF and above while just over 5 million were APS-C and below. Both numbers show about ~5% increase year to year.

Total number of lenses 2007-2024

Non-Interchangeable lens cameras

Non-Interchangeable lens cameras

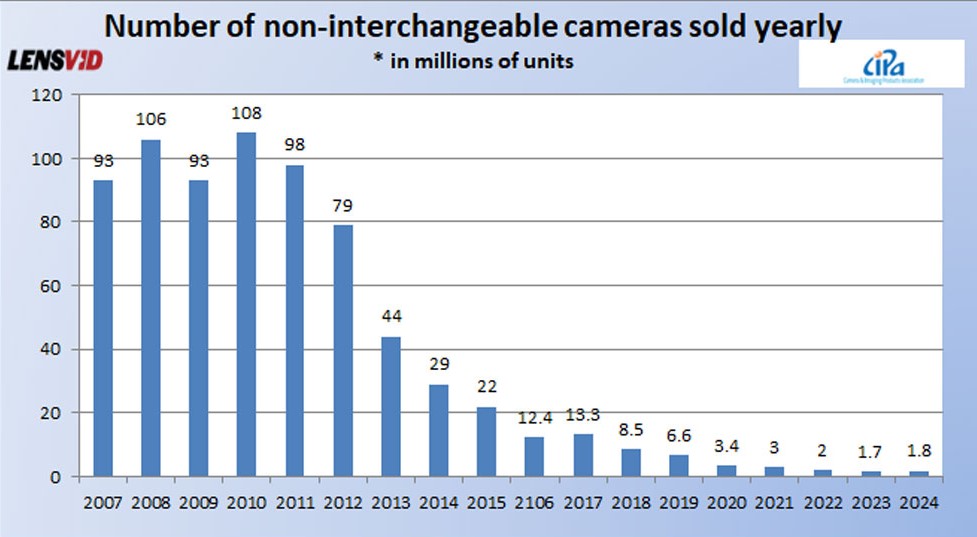

Now we look a little deeper at the breakdown of cameras and we start with non-interchangeable lens cameras (i.e. compact cameras/super zooms). Just like with cameras in general, this is the first year since 2017 where we see a (small) increase in compact cameras shipped.

We are not exactly sure what is behind this increase from 1.7 million in 2023 to 2.9 million in 2024 but it is interesting. One speculation that we had in the video above is that Fujifilm is a big contributor here both in the instant camera market but also in the large sensor segment with the X100 line, but there could be other factors.

Compact cameras – 2007-2024

interchangeable lens cameras

interchangeable lens cameras

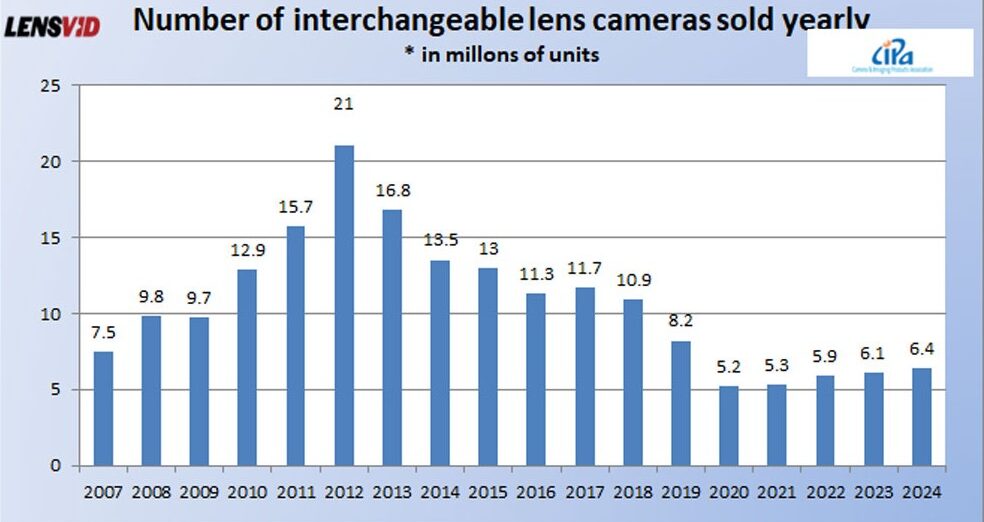

Looking at the larger segment of the camera market, the interchangeable lens cameras (both DSLRs and mirrorless cameras) we see an increase of close to 5% from 6.1 in 2023 to 6.4 million cameras.

We will need to look more deeply in the next slide for the actual division between DSLRs and mirrorless to gain a better understanding of the trends.

Interchangeable lens cameras 2007-2024

DSLR vs. Mirrorless

DSLR vs. Mirrorless

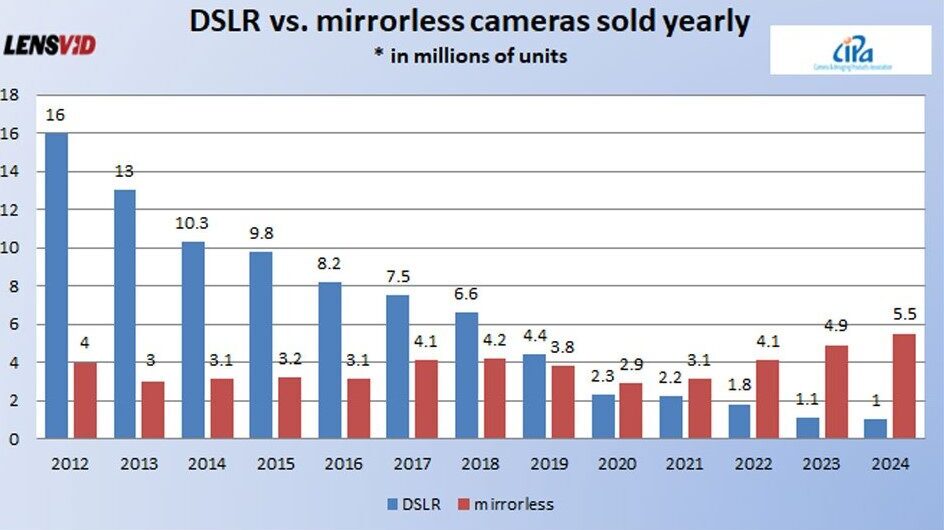

Maybe the most interesting table in recent years has been the one looking at DSLR vs. mirrorless cameras. This year we continue to see the same trend as we have seen in past years with mirrorless cameras increasing and DSLRs decreasing.

This is not surprising, to say the least as the last major DSLR announcement (if you don’t include Pentax) was in 2019. Yet there are still about 1 million DSLRs sold in 2024. Who is buying them and what segment of the market are they sold in (entry-level or more advanced ones? We had some speculations in the video).

The mirrorless segment did increase by about 12% which is certainly impressive and like last year, represents the highest number of mirrorless sold in a year (we are still in shock that 4 million mirrorless cameras were sold way back in 2012)

Number of DSLRs vs. Mirrorless cameras – 2012-2024

Regional camera statistics

Regional camera statistics

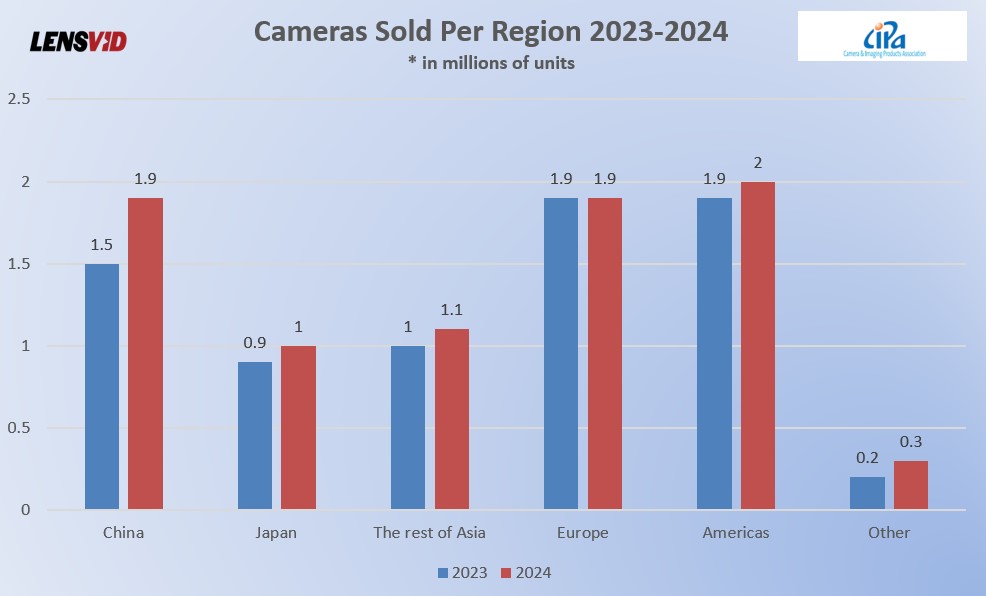

Finally, we wanted to look at regional camera (all cameras) sales/shipments in different regions of the world. CIPA divides the world into Japan, China, (rest of) Asia, the Americas, and all other regions.

Looking at the chart below we immediately see that China was the fastest-growing region in 2024 with almost 2 million cameras in 2024 (it was also the same for 2023 compared to 2022 with an increase from 1.2 to 1.5 million units). Europe stayed more or less the same while all other areas saw a minor increase in shipped cameras.

Total cameras by region – 2023 vs. 2024

Conclusion

Conclusion

Looking ahead to 2025 we don’t expect big changes. If anything we believe that unless some big global changes occur this year (again), we are going to see mostly more of the same with possibly a slight increase in sales (especially with mirrorless cameras at the expense of DSLRs) and maybe even an increase in compact cameras thanks to the interest in the X100 line from Fujifilm (and possibly a new RX1 replacement) and some of the instant cameras (even basic compacts have seen a renewed interest, especially in Japan).

Past coverage

You can check out all our previous videos/articles about the camera industry below:

- What Happened to the Photography Industry in 2013?

- What Happened to the Photography Industry in 2014?

- What Happened to the Photography Industry in 2015?

- What Happened to the Photography Industry in 2016?

- What Happened to the Photography Industry in 2017?

- What Happened to the Photography Industry in 2018?

- What Happened to the Photo Industry: 2010-2020 – The Big Fall

- What Happened to the Photo Industry: 2020-2021

- What Happened to the Camera Industry in 2022?

- What Happened to the Camera Industry in 2023?

You can check out more LensVid exclusive articles and reviews on the following link.

You can support LensVid by shopping with our affiliate partners

Affiliates: Amazon, B&H, Adorama and E-bay.

Why should you trust us?